In recent years the finance and business worlds have seen a new trend emerging in the use of EFT payments (Electronic Funds Transfers). But EFT payments are nothing new, they have been around for years all across the world, so what’s going on here? To find out more, we’re going to take a look at EFT payments in today’s digital age.

What is An EFT?

EFT is traditionally a broad term used to describe any digital transfer of money that is conducted through a digital payment system. Some examples include electronic checks, direct deposits, atm withdrawals and even card transactions.

Today it is used in Canada as a term to describe electronic transfers that are primarily sent through Canada’s legacy electronic payment rail, the Automated Clearing Settlement System (ACSS). While it is considered a legacy rail, it still moves a vast amount of the country’s payments, accounting for $9 trillion Canadian dollars in 2022.

A Brief History Of EFT Payments

Electronic payments have been around for a lot longer than people realize, albeit in varying formats:

- 1871 – Yes you read correctly. Western Union in the US completed the first electronic payment, where someone could pay for goods without being present.

- 1958 – First credit card transaction completed by Bank of America

- 1980 – Canadian Payments Association established, ACSS system began processing payments 4 years later

- 1995 – First contactless payment system

In the not-so-distant past, traditional banking methods relied heavily on manual processes and paper-based transactions. The need for a more efficient, secure, and swift method of transferring funds led to the conceptualization of the Electronic Funds Transfer. The late 20th century witnessed the birth of the modern EFT, marking a revolutionary shift in the way financial transactions were conducted.

Uncovering Modern EFT Payments

Traditional EFT payments have several advantages over say credit card payments:

- They can be scaled – Banks and businesses can upload files containing thousands of EFTs that can all be submitted for processing at the same time

- They are cost effective – Generally EFT payments are processed at a fixed rate, so they are more cost effective than credit card payments

- They don’t require the payor to be present – The buyer can authorize recurring debits and credits using EFT payments

However, there are a few disadvantages:

- They are slow – EFT payments usually take up to 3 days to be processed fully

- They have limited visibility – While the transaction is in progress, it is difficult to see what stage it is in

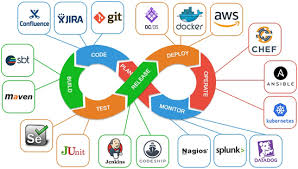

Modern EFT payments have started to remove the effects of some of the disadvantages, and even improve on the advantages of the existing system. This is done primarily through open-source software and open banking data. With these, EFT payments can be sped up to same-day transaction times, with full visibility of where the transaction stands.

Implementing EFT Payments: A Step-by-Step Guide

Now that we’ve explored the advantages of EFT payments, let’s delve into the practical aspects of implementing this payment method:

- Choose a Reputable Payment Processor

Selecting a trustworthy payment processor is crucial for the success of your EFT transactions. Research and opt for a provider with a proven track record, robust security features, and a user-friendly interface.

- Link Your Bank Account

To initiate EFT payments, you’ll need to link your bank account to the chosen payment processor. This step ensures a seamless flow of funds between your account and the recipient’s account.

- Verify Security Protocols

Before conducting any transactions, verify the security protocols implemented by your chosen payment processor. This may include encryption standards, secure authentication methods, and fraud detection mechanisms.

- Always Test Transactions

Once the setup is complete, you must make sure you send and receive a few test transactions before opening up to customers. Send a few small transactions from various accounts to ensure your setup is rock solid.

Overcoming Common Concerns About EFT Payments

While EFT payments bring numerous benefits, some individuals and businesses may have reservations due to common misconceptions. Let’s address these concerns and shed light on the realities of EFT transactions.

- Security Concerns

One prevalent misconception is that EFT payments are susceptible to security breaches. In reality, modern EFT transactions incorporate state-of-the-art security measures, often surpassing the security of other payment methods like credit cards.

- Complexity of Implementation

Some may fear the complexity of implementing EFT payments. However today’s EFT platforms have intuitive interfaces and clear instructions to ensure the process is straightforward, even for those less familiar with digital transactions.

- Lack of Control

Individuals may worry about a perceived lack of control over EFT transactions. Contrary to this belief, today’s EFT systems offer transparency and detailed transaction histories, providing users with a comprehensive view of their financial activities.

Conclusion: Embracing the Future of Transactions

In conclusion, modern-day Electronic Funds Transfer payments represent a significant leap forward in the world of financial transactions. From speed and efficiency to enhanced security measures, the advantages of EFT payments are reshaping how we handle our finances. By understanding the mechanics, implementing with confidence, and dispelling common concerns, individuals and businesses can unlock the full potential of EFT payments, ushering in a new era of seamless and secure transactions in the digital age.

Discussion about this post