To get an opportunity to construct a building connects, it is usually necessary to show that you’re able to determine the amount of money that will be involved in the construction. This typically requires the preparation of an elaborate tender that outlines precisely what is needed to be spent and at what point. Cost estimation can be a challenge, and many factors must be taken into consideration before the submission of a quotation or tender. Estimating the labor costs is not easy since it depends on knowing the number of individuals you will need to finish the task. It also requires estimates for certain aspects of the job that might not directly relate to construction.

Thank you for reading this post, don't forget to subscribe!Experience in the field is helpful since it gives an understanding before the task, as does having a steady team of employees you can trust to complete the work. One of the biggest challenges is estimating how long the project will require, directly affecting the amount of work needed to finish the project. Make a timetable for the project and be realistic about timeframes. Make sure to be as efficient as possible; however, don’t compromise on allocating tasks. If a job requires two workers, don’t base your costs on just one person doing the homework. Make sure you allow for errors in your estimation.

The price of the materials is another critical aspect to consider. It is essential to have an accurate idea of what you will need to complete the task and how it is available at a cost suitable to all parties. It is generally recommended to involve an architect or another expert to tell you the quantity of each item you will require. Be aware that the cost of this professional should also be considered. Finding reliable sources for materials can also be beneficial since it guarantees that you will receive solid estimates on your estimates. Finding new suppliers could cause problems with the assessment they offer and, in turn, result in issues in the final calculation.

The industry has realized the difficulty of determining the cost of a construction project, and there is a variety of cost estimation software for purchase on the market. Using one of these will give you a basis to build your full quote on and ensure that you are covered for every base. Keep in mind that the software will have some initial expenses, but it’s not advised to include this in your estimate when submitting the contract.

Some of these programs let a database be kept about each item’s cost and permit calculations, including your mark-up on purchased products and other essential measures. If properly trained, these programs will streamline the entire process, making it easier to give an accurate estimate of the work to be done.

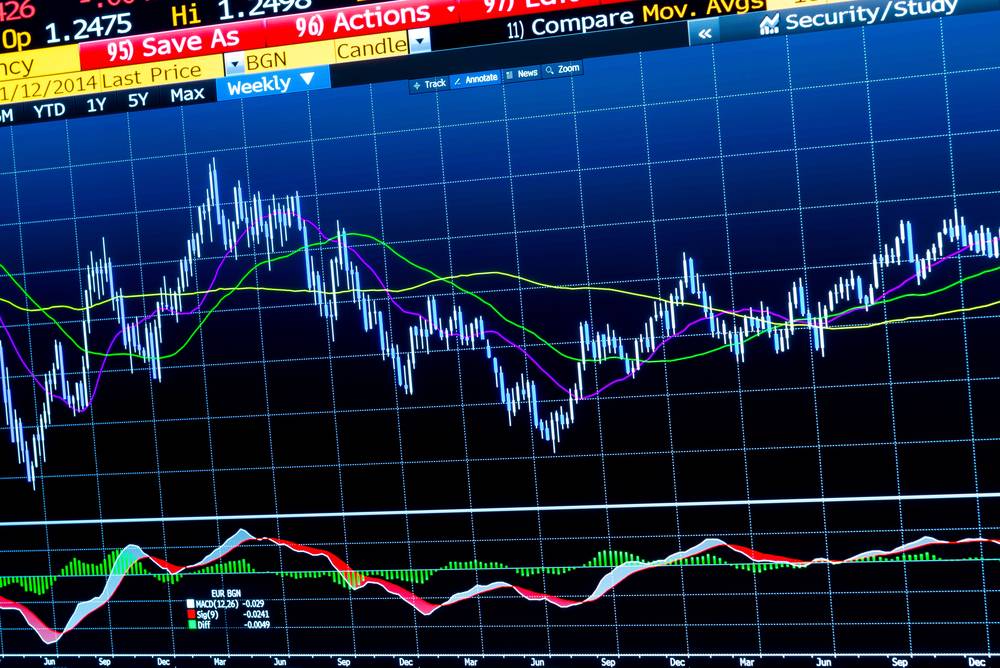

Utilizing a commercial accurate property loan calculator to calculate the loan’s payments and loan amounts, the next step to developing a property investment strategy is to look at cash flow estimates and forecast financial information. With the rise in real estate prices across the country, properties listed today will rise in value over the coming years. Major lenders are easing the restrictions for a construction loan; investors will have the possibility of building new facilities, preparing for the future flow of cash, or purchasing existing structures that can generate immediate cash flow. One of the best aspects of a Commercial Estimation mortgage calculator is that the ability to enter different numbers helps investors anticipate the possibility of adverse cash flow problems. A difference of only one fraction of a percentage on mortgage calculators for residential properties can result in an insignificant difference in the monthly payment amount.

But, altering the proportions and amortization information in a commercial calculator can result in drastically different outcomes when more significant properties are under review for investment. A property worth several million dollars will require each penny to be scrutinized. On the other hand, an investment property that needs a couple hundred thousand dollars of the investment may offer some “wiggle” room regarding payments. Many investors today are beginning to buy properties without proper financial analysis to determine whether the properties can provide a future rental income; in addition to the use of commercial real estate loans calculator to estimate the cost of payments, investors should also take into consideration closing expenses, rehabilitation costs and operating costs.